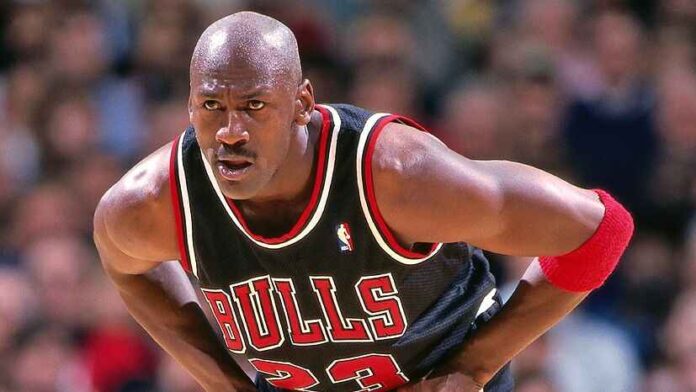

Michael Jordan, widely regarded as the greatest basketball player of all time, has translated his success on the court to the business world. His savvy investments have built a remarkable empire, making him one of the wealthiest athletes in the world.

Early Investment Ventures

Jordan’s investment journey began in the 1990s, with a focus on real estate and restaurants. He partnered with his business manager, Curtis Polk, to establish Jordan’s Restaurant in Chicago.

Key Investments:

1. Charlotte Hornets: Jordan purchased a majority stake in the NBA team in 2010 for $175 million. The team is now valued at over $1.7 billion.

2. 23XI Racing: Jordan co-founded this NASCAR Cup Series team with Denny Hamlin in 2020.

3. Jumpman Gaming: Jordan partnered with DraftKings to launch an esports platform.

4. Restaurant Ventures: Jordan owns stakes in several restaurants, including Michael Jordan’s Steak House.

5. Golf Course: Jordan invested in Grove XXIII, a private golf course in Florida.

Read More About: Michael Jordan Net Worth : Slam Dunk Success

Real Estate Investments

Jordan’s real estate portfolio includes:

1. Chicago Penthouse: A $3.9 million luxury penthouse.

2. Florida Mansion: A $4.8 million estate in Palm Beach Gardens.

3. Charlotte Condo: A $2.7 million condominium.

Private Equity and Venture Capital

Jordan has invested in various private equity and venture capital funds, including:

1. Ares Management: A global private equity firm.

2. Apollo Global Management: A leading private equity and venture capital firm.

Philanthropic Efforts

Jordan’s investment philosophy extends to philanthropy:

1. Michael Jordan Foundation: Supports education, healthcare, and youth development initiatives.

2. United Negro College Fund: Jordan has donated significantly to this organization.

Investment Strategy

Jordan’s investment approach focuses on:

1. Diversification: Spreading investments across industries.

2. Long-term growth: Prioritizing sustainable returns.

3. Partnerships: Collaborating with experienced partners.

Conclusion

Michael Jordan’s investment success demonstrates his business acumen and strategic thinking. By diversifying his portfolio and partnering with experts, Jordan has built a remarkable business empire.